India's Foreign Debt and Imperialism

It is long since we have heard the Indian rulers or their pet intellectuals talk about India's foreign debt. Instead, the government and the media both boast of India's foreign exchange reserve, 'robust' and 'second speediest' economy, etc.

India's foreign debt was an often-discussed topic around 1990-91, though. What does this silence prevailing since then signify? Has India been rid of its foreign debt or is it approaching that blessed state? Is it that we really do not need to be concerned about such debts? We will discuss about it here, but let us recall the situation during 1990-91 first.

In 1990-91, the ruling class told us that India's foreign exchange (Forex) reserve had almost touched the bottom mark. A bulletin published by the Reserve Bank of India in January 1991, reveals that the Forex reserve stood at a mere $750 million then. The monthly spending due to import at that time was $350-400 million on an average. That is, the balance at the foreign exchange reserve was hardly sufficient for supporting import expenditure even for two months. One must add to it the liability due to the foreign loan taken up till then. Obviously, such a situation made the Indian rulers shaky. Alarm bells were sounded from many quarters that India was falling into a debt-trap like the Latin American countries.

All this sent the Indian rulers prostrating themselves before the imperialist lending organizations, the World Bank and the International Monetary Fund, who promptly used the opportunity and came up with huge offers of loan. India was lent Rupees 5000 crore by the IMF and Rupees 1000 crore by the World Bank at one go. In exchange, they imposed a number of conditions on the Indian government which passed as "structural reforms". The main aspects were as follows: 1) devaluation of the Rupee and its full convertibility in the international market; 2) abolition of import duty; 3) withdrawal of government subsidy in public welfare sectors like education, health, rationing system, etc.; 4) handing over of the public sector undertakings to private owners; 5) elimination of hurdles for easy entry of foreign capital, abolition of the licensing system for foreign investment (direct and indirect) and of any upper limit thereon.

Signing the memorandum containing these conditions, the then Finance Minister (the present Prime Minister), Dr. Manmohan Singh had said that thenceforth the Government's policy would be: to ensure efficiency in industry so that India could compete in the international market; to encourage foreign investment and invite more foreign technology than was applied in the past; to make the PSUs more efficient and reduce the government's role in them. The picture of future India was painted in colours by the ruling class at that time. "Foreign capital and technology will enhance the quality, quantity and multiplicity of Indian products; it will help Indian commodities stay in the competitive international market; exports will grow; consequently, dollars will flow into India's Forex reserve; and then, not only will we be able to repay our foreign debt, but the development of India's own economy will automatically reduce the necessity for borrowings", they said. And they appealed to the masses to sacrifice willingly for such a prosperous future. But what do we find today after seventeen years? The toiling masses have been robbed of even the trifling benefits that they had earned through previous struggles. In the name of sacrifice, gone are the public welfare schemes like security of food, health and education. But do we stand less indebted to the imperialists now in exchange of our sacrifice? On the contrary: The clutch of imperialism over the Indian people is getting firmer than ever today.

Foreign Debt — as in 2008-09

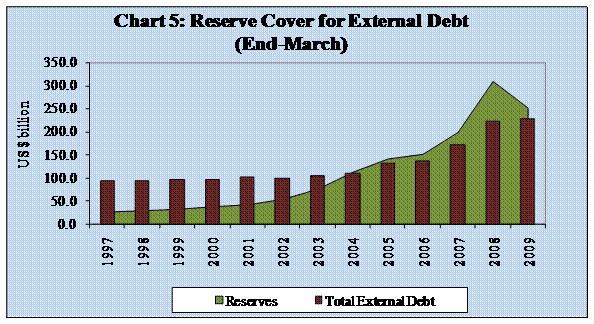

According to the bulletin published by the Reserve Bank of India, India's foreign debt up to March 2009 stood at $229.9 billion, while it was $ 224.6 billion up to March 2008. Taking India's population to be 110 crore, this implies that every Indian carries a foreign loan of Rupees 10,024 on his head. In a country where the daily income of nearly the half of the population (or about 50 crores of people) is Rs.10-12, one can imagine the enormity of the debt. And the amount of its yearly interest is also huge. The masses of India have to consume less and toil extra time to repay this debt, and the yoke of poverty is continuously pressing harder on the shoulders of the common man. In March 1991, our foreign debt was $83.8 billion. The exchange rate was Rs.20 against $1 at that time. Taking India's population to be 100 crore then, the per capita loan was Rs.1,664. That is, over the period 1991-2009, India's foreign debt per capita has increased 6.7 times while total debt has increased 2.74 times.

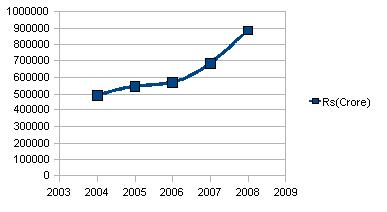

During the recent years, especially after 2002, the rate of increase of foreign debt has risen considerably (Graph-1). In March 2006, India's foreign debt stood at Rs. 569,672 crore which increased to Rs. 884,516 crore in March 2007. That is, the rate of increase comes to 29.8% per annum. Again, this rate of increase is 431.6% more in 2008 compared with 1991. It is clearly seen that even as the total amount of debt is growing over the years, the yearly rate of increase is also ascending continuously. Hence, any respite from our crushing foreign debt seems distant.

The portion of the principal amount which is to be repaid in a year plus the yearly interest, make up the yearlydebt service. As the interest grows, debt service also increases. India's debt service has increased three times over the period 1991-2008.

While the actual condition is as pictured above, the rulers of India assures us that our foreign loan situation is within control. The amount of debt is deliberately shown as diminutive in proportion to GDP to prove that it is repayable. Yet another account is presented whereby it is shown that India's foreign exchange reserve has enough balance to repay foreign loan. May we ask then, that what is the need of further borrowings at high interest when the Forex reserve is in such healthy position? The imperialist lending organisations like the World Bank are also saying that India has overcome her indebtedness to some extent and thus she may be considered as an "indebted country of the medium range"! It is clear that we must look through this big talk about India's Forex reserve.

What inflates the Forex reserve?

Let us first take a look at the approximate relation between foreign debt and foreign exchange reserve. The international lending organisations and the imperialist countries lend money in their own currencies, i.e., in Dollar, Euro, Yen, etc. and the borrower countries have to repay them in same currencies. Thus, the debtor country has to keep a minimum balance at its Forex reserve to ensure yearly debt service. Otherwise, the imperialists pressurize it in many ways for the simple reason that the imperialists not only ensure easy entry of their capital into a country, but also an easy exit from there.

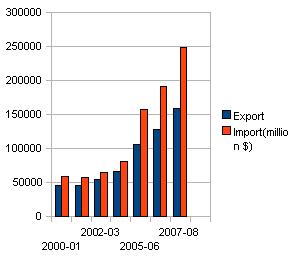

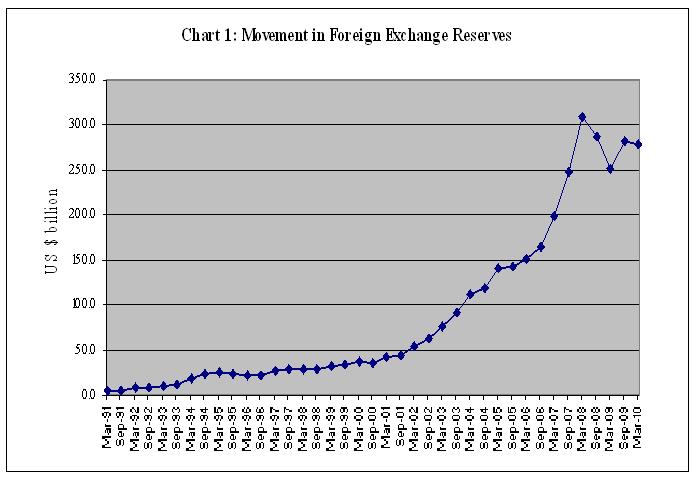

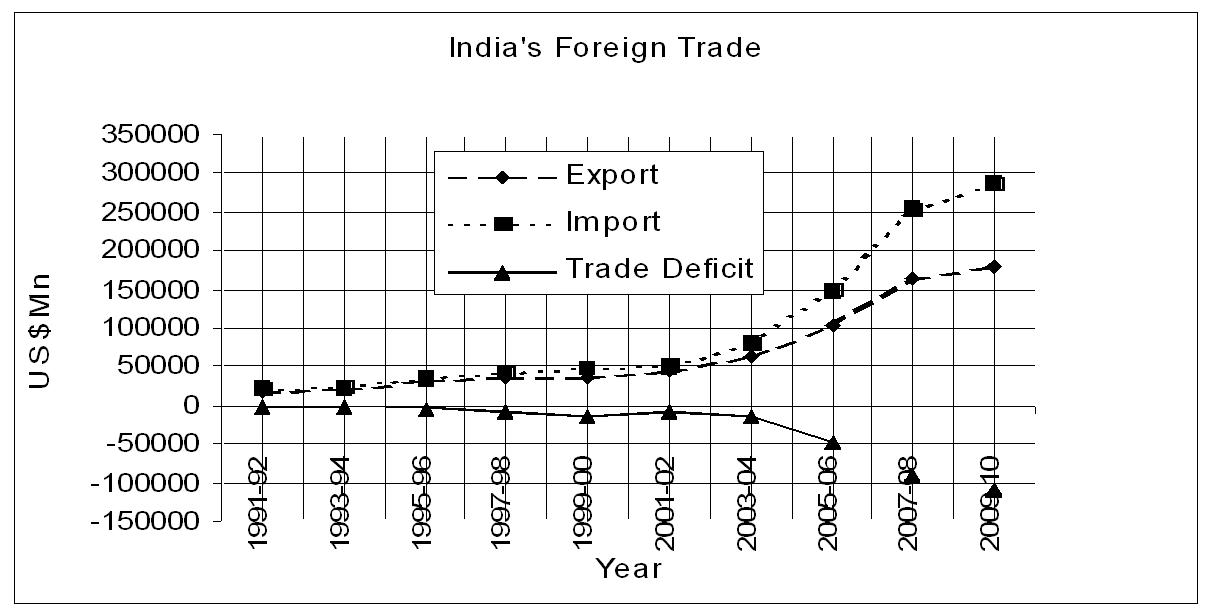

Graph no.-2 shows that India's Forex reserve is swelling every year. But where has such large amount of foreign currency come from? Foreign currency can enter a country through export and leave through import. For a country like India, which is heavily dependent on the imperialist countries, there is little possibility that export would outgrow import. It never happened. Of course export has increased since 1991. But it has invariably been overtaken by import which has resulted in increased trade deficit every year. Foreign currency is to be extracted from the Forex reserve to meet this deficit every year. (The increase in trade deficit can be seen from Graph-3). So, growth of export has not contributed to dilate the Forex reserve.

Another source of foreign currency is the "invisible account". This includes income of foreign currency through software or outsourced jobs, tourism industry, etc. which are developing sectors nowadays. Then there is "investment income", i.e., when a small portion of the profit gained through FDI is reinvested within the country. Again, when a person or company exchanges foreign currency for money, it goes to fill the Forex reserve. But all this income taken together cannot compensate for the trade deficit.

Thus it is amply clear that the growth of Forex reserve is not accounted for by a self-reliant economy, i.e., one that yields enough industrial and agricultural products which can be exported after satisfying the need within the country, and, which in turn can fetch foreign currency.

Other processes which contribute to inflate the Forex reserve are: 1) foreign loan, 2) foreign direct investment (FDI), 3) foreign indirect investment (FII). We have already seen how India's foreign debt is increasing continuously. The total investment through FDI and FII since April 2007 to September 2008 was $9.036 billion, while the external debt figure for the same period was $7.383 billion. The corresponding figures for the previous year were $23.305 billion (FDI &FII investment) and $18.461 billion (external debt), respectively. [Source: Monthly Bulletin of the Reserve Bank of India, December 2008]. It may be noted that as economic crisis hit the flow of imperialist capital worldwide, the amount of foreign capital entering India decreased in 2008-09 in comparison with 2007-08.

The above data regarding augmentation of the foreign exchange reserve compels us to realize an alarming fact — that imperialist capital is infiltrating both debt and non-debt sectors of India in an ever increasing rate. And this infiltration is more in the non-debt sector than the debt sector. The IMF & the World Bank etc. continue their aggression upon us in the familiar way when they grant loans. FDI and FII pose new dangers before us. The situation is thus far from comforting — as the ruling class will make us believe sighting a fat Forex reserve.

Another point to be remembered, since the Forex reserve is swelled up by dollars actually owned by others, the Government of India has no control or say over it. Obviously, the imperialists have no intension for charity. They invest here to ensure a "super profit". The slightest threat to this possibility makes them fidgety, and their capital takes flight as soon as they smell some uncertainty. They have earlier shown this tendency on other parts of the world. And, even as $61.4 billion foreign capital had entered the share markets of this country in 2007-08, with the onset of the continuing crisis, $11.1 billion of foreign investment went out over a period of 6-7 months in 2008. During that period, the amount of foreign capital leaving India out figured capital inflow. The condition of the Forex reserve clearly showed this. While the balance at the reserve stood at $309.7 billion in April 2008, it became $283.94 billion in August. [Source: RBI Bulletin]. The decreasing trend is still valid, as on 30th September, 2009 it became $281.278 billion and on 31st March, 2010 it was further lowered to $ 279.057 billion (source — RBI Press Release, 04.08.2010). On imperialist dictation, the Government has set the conditions for FDI in such a way that, even such directly invested capital can instantly fly away from the country. We may recollect that how the US company Enron had walked out without the least hindrance after making a huge profit in the power sector of the state of Maharashtra.

Post-1991 Imperialist Design in External Debt Sector

Announcing the credit policy for India in 1992, the Asian Development Bank (ADB) — the Asian branch of the World Bank — said, "Grant of loans must expedite economic reforms and must build a structure that would open the door to private investment in future". [ADB Bulletin]. It is clear that post-1991; imperialist capital was pushed into the country in the name of loans only to enforce structural changes. These changes include administrative and legal reforms which pave the way for investment of imperialist capital and organize the whole internal structure of the country in such a way that the imperialists can reap it. One may remember the infamous comment by Mrs. Carla Hills at that time: "We will break open all closed doors with shovels"! Only now are we realizing the full impact of their plans around structural reforms which is scarcely hidden in this audacious comment. By imposing one by one most harsh and strict conditions on the Indian people, and with good compliance from the big bourgeoisie of the country, they have been quite successful in shaping the internal structure of India in such a fashion that, now they themselves can wield it for extracting super profit from India. Effacing the welfare state, intensifying exploitation of the toiling masses by robbing them of their basic and minimum rights, capturing all natural resources of the country including land, water and minerals — within a span of mere fifteen or sixteen years, they have achieved all these to their own benefaction. No, they did not have to wage a war for it. Nor did they have to make any kind of concession whatsoever to beget such opportunities. Such is the age of imperialism.

Changing pattern of the component parts of external debt

Bilateral and multilateral debt: We recognize the IMF as an imperialist lending organization. Yet the startling fact is that the Indian government's obligation to the IMF has come down to zero in 2001 and it remains so till date. Does it mean that the Indian people are freed from the clutches of this Dracula? Of course not. We must remember that the IMF lent to the government of India chiefly to compel it to effect structural changes in favour of the imperialists. The just mentioned fact implies that their need for further such changes has decreased. Again, the amount of loan that used to flow here from the imperialist countries has steadily been on the wane with respect to the total yearly loan. In 1990-91, the amount of India's bilateral and multilateral debt (i.e., borrowing arranged between two governments, and though the mediation of some fund organization where the imperialist countries deposit their capital— like the IMF, World Bank etc. — respectively) was $ 35.064 billion while its total debt was $83.8 billion. This means that bilateral and multilateral borrowings constituted 42.25% of the total debt. This share has fallen to 24.2% [Table 2]. Yet, before 1990, one of the main channels through which imperialist capital entered this country was multilateral and bilateral loan. It can be seen, therefore, that as imperialism is being firmly entrenched in this land, their objective need to invest capital in a roundabout way is declining. The various regulations and restrictions which existed earlier had barred them from direct investment in many a way. Now they can easily earn super profit through more direct processes. But these facts then naturally pose another question as to why does then the total amount of external debt continue to increase?

External commercial borrowings [ECB]: This component of the total external debt is increasing in an unprecedented way during the last few years. ECB constituted only 12.2% of the total external debt. In March 2008, this came out to be 28.1%. [Those who are interested may see Tables 1&2 to compare the change in share of this component in total external debt]. But who are the borrowers of this kind of loan? The big monopoly capitalists of the land and the multinational companies engaged in business here borrow from the foreign banks and international lending organizations for their business purposes. Since the rate of interest in these organizations of the developed countries is much less than that of the national banks, these firms borrow from them quite indiscriminately. And our government has obliged them by withdrawing all restrictions on such borrowings. Excepting some minor regulations, practically no permission is required now for such loans. For example, borrowing for real estate development was not allowed previously. Now it can be done for a township (to be) built even over 100 acres. The government is also continuously raising the upper limit of the amount of loan that can be taken under this head. This limit, which previously was $50 million, has now become $500 million in a year. Further, units in the Special Economic Zone (SEZ) are also permitted to access ECBs for their own requirements. However, ECB is not permissible for the development of SEZ. It has now been decided to allow SEZ developers also to avail of ECB under the Approval route for providing infrastructure facilities, as defined in the ECB policy, within the SEZ. Since the loan is to be repaid in dollars, a minimum balance of the dollar is to be maintained by the government for which, again, it has to approach the imperialist organizations. Thus it is the people who have to ultimately bear the burden of the ECBs — which serves nobody but the interest of imperialist and monopoly capital.

Short—term loans: In 2002-03, the share of short-term debt in total external debt was 4.5%. Thus, debt under this head is growing at quite a fast rate. These loans are taken for paying import dues and they have to be repaid within a maximum period of 1-2 years. Obviously, the borrowers in this case also are the big and monopoly capitalists of the country. Since the rates of interest for these loans are very high, debt-service also rises steeply. Yet another liability is that, since the term is short, a large sum in dollars must be kept ready for repaying a big loan.

Thus it is amply clear that the main factor behind the growth of total external debt is the increase in borrowings by the multinational and monopolist companies and they are passing the liability onto the people via the government.

Imperialist exploitation on the Indian people

In the above discussion, we have seen that to get a true picture of imperialist investment in India, one have to take into account both debt and non-debt sectors. In the debt sector, the imperialists earn profit through interest. In the non-debt sector, this must be calculated from the dividend or the direct amount of profit extracted from this land. The imperialists have simply gained Rupees 69,258 crore from debt-service in 2007-08, while it was Rupees17, 960 crore only in 1990-91. So it is a four times increase in 15-16 years.

But the actual amount extracted out of India in the non-debt sector — which offers us an idea of the intensity of imperialist exploitation — cannot be obtained so easily from government statistics. For, these transactions are not made public wholly, and we have to be satisfied with only an approximate account. In 2006-07, the balance of payment (B.O.P.) account shows an amount of $3.486 billion as profit and dividend from foreign investments. In 2007-08, it increased to $3.576 billion or Rupees 16,092 crore. Within April to September of 2008, this amount is shown to be $2.272 billion or Rupees 10,905.6 crore. Thus it is growing by leaps and bounds.

Away with statistics. Imperialist exploitation is affecting every sphere of public life. We may take a relevant example in what happened in India's power sector, for it will show this effect in reality. In compliance with imperialist dictation, the power sector, like other sectors, is being fully privatised in a step-by-step way since 1990 in the name of reforms. From the very onset, as a condition for granting loans to the power sector, the World Bank had demanded deregulation or withdrawal of government control in the sector. It prescribed privatisation of the departments of generation, transmission and distribution of power which the government obediently implemented through the National Power Policy of 2003. Private concerns were allowed to do business in these three fields of the power sector. Thus invited, some big players entered the arena whose sole business is to buy power from the power-rich states and to sell it to the deficient ones. What is more, foreign companies investing in the sector have been assured of a minimum 16% profit by the government, and they can repatriate the whole of it to their native countries, converting the money into dollars right from India!

Now please take a look upon the result speculative business affected upon power tariff. In 2006-07, only 3-5% of the total electricity generated was marketed through private business. The charge for 95% of this was Rupees 2-6 per unit. But the next year the tariff jumped to Rupees 8-12. The World Bank commanded that transmission of power to all parts of the country must be controlled from a centralized power grid. This policy is soon going to be implemented. Under the system, all the power plants in the country will supply electricity to the central grid, which will certainly be owned by imperialist multinationals and monopolist houses of the country. The sole purpose of constructing such a grid is to build one integrated market for power — from which even the states that generate power will be compelled to buy should they need some extra supply. It is clear that the likes of the World Bank are insisting on installing such grid only in the interest that the imperialists may earn profit by merely trading in electricity. Both foreign and national monopoly capital has already been able to clear the way so that they can make huge profit out of their investment and speculation in the power sector. Till now, only 3-5% of the electricity generated is selling through their hands. The full effect of the games they play is, therefore, yet to be realized by the customers. But in the coming days, power tariff will wholly be determined by speculators and we will have no option but to pay. [The Business World of 15 January 2009 shows that these speculators are fixing the power tariff quite arbitrarily while the production cost is only 87 paise per unit]. To facilitate foreign investment in this sector, the government has opened an "automatic route" — a system whereby no government permission is required for taking a foreign loan.

Fulfilling the condition of the World Bank loan, the electricity board in every state was converted into corporations. Before corporatization, each state government was directed to see to it that the organization was running profitably; as, otherwise, private investors would not be interested. The Delhi government had to fish out Rupees 2400 crore before privatising its State Board of Electricity. And the Planning Commission has brought out an estimate which shows that to follow the "Delhi model" in all states, a total amount of Rupees 1,000,00 crore is required [Source: The Times of India, 23.12.2008]. So ultimately it is the people who will have to bear the burden of this astronomical amount which will be drawn from the Public exchequer.

During early 1990, a hydroelectric project was planned in the state of Orissa with a loan from the World Bank. But later, it was abandoned. The government had to withdraw following protests from the local people over rehabilitation. The World Bank cancelled this project and immediately announced that they were cancelling other loans to the Orissa State Electricity Board — for a number of works sanctioned by them — too until the government of Orissa had obeyed all of their conditions. And, within no time after this refusal, a multinational advisory firm was engaged by the Orissa government who prescribed its 'expert's opinion' for full privatisation of the generation and distribution systems of the power sector in the state. These 'experts' were paid a sum of Rupees 306.422 crore by the government. [Source: Frontline, 11-24 may, 2002]. The Orissa government was then coerced into surrendering the State Electricity Board into private hands. The American company AES took over the major portions of the electricity generation and distribution systems in 1996 and only a small part was kept by the Public company GridCo. Hydroelectricity, which was low-priced in Orissa, began to cost higher and higher ever since privatization. Its charge rose from Rupees 2.01 to Rupees 4.34 per unit within a year. The National Power Policy, in accordance with the World Bank prescription, itself announced that, subsidy for customers with low consumption would be abolished step by step and the policy be implemented in every state. For Orissa, the result was disastrous. Most poor people were compelled to stop using electricity. AES continued to charge arbitrary bills by capturing the distribution system. At the same time, they left huge outstanding amounts with Gridco, i.e., the government had to practically bear their cost almost entirely. Foreign advisors were engaged, whom again the government paid large 'honorarium'. Thus, while Gridco's outside debt before privatisation was Rupees 820 crore, it increased to Rupees 3300 crore later. Unto the last, when AES withdrew from Orissa's power sector, it owed Rupees 422 crore to Gridco. However, the World Bank termed all this cheating and extortion as 'ideal' for the process of privatisation! [Source: Annual Bulletin of ADB, 2002]. Naturally it was ideal for them because they were able to profit immensely by squeezing the people and by passing the buck unto Gridco, alias the government.

The above facts regarding the power sector is only one example of how imperialism is pushing its way into every field of the country under the leadership of the World Bank etc. The conditions that they set before sanctioning any loan intend nothing but to ensure that they may go unhindered in their pursuit for profit and cast the net of exploitation over the people to extract the maximum out of them. These conditions are so inseparably linked with imperialist lending, that it becomes impossible for a dependent country to do otherwise than get practically enslaved by imperialism.

Let us examine the some of the main conditions linked with imperialist loans: devaluation of the Rupee, liberalization of import, abolition of social welfare schemes, cancellation of the licensing system and withdrawal of upper limits for foreign investment etc.

What is the main impact of rupee devaluation? Leaving other things, import expenditure has increased many times. In a backward country like India, where industrial production is heavily dependent on foreign technology and imported machinery, this increase produced a cumulative effect. An increased supply of foreign currency is constantly needed in the current account to meet import dues. This again necessitates foreign loans and the imperialists are once again invited to rescue us!

The policy of liberalization of import has created in India a very big market for foreign firms. The story about repaying foreign debt with increased production and growing exports proved to be false as it was an impossible project in reality. All backward countries, including India, are the principal harvesting fields for imperialist investment and imperialism nips in the bud any possibility of shrinking of this field. It is obvious that self-reliance cannot be achieved through a path of dependence on imperialism.

Moreover, to increase export, the system of production must be developed, which entails for us import of foreign technology and foreign machinery. Thus, for India, growth of export is impossible without a corresponding growth of import. And we have already seen that that necessitate an increased supply of foreign currency for which again imperialist loans must be sought. It comes to a full circle. In either direction we cannot save ourselves from imperialist exploitation.

The few restrictions and regulations, which existed before 1990-91 for preventing foreign capital from investing in this land, have been withdrawn under the compulsion of the harsh conditions of imperialist loan. For example, before 1990-91, foreign capital could be invested to a maximum extent of 40%, and that too only in a few limited sectors, after obtaining permission from the government. In the name of 'structural reforms' and deregulation, the government has opened up the provision for 100% foreign (direct and indirect) investment in practically all sectors. Entry and exit of imperialist capital have been facilitated by opening of "automatic routes" in these sectors. Thus the imperialists' intention behind sanctioning loans consist not only in extracting profit through debt-service, but to arrange for a most favourable condition for their investment through tough conditions linked with these loans thrust upon a dependent nation. The people of India today are not only entrapped in a net of debt, but also in an all-pervading and overwhelmingly exploitative net of imperialist exploitation. Imperialism has encroached upon our lives by smashing and breaking open all our "closed doors". Behind every dollar of profit they make from here lies the tale of immense suffering and pauperization of the multitudes. The only way out from this exploitation and imperialist control is to oust them, to extirpate imperialism for ever. History is calling upon us to take up this task or perish. And, to fulfill its demand, a conscious process for preparation of the proletariat must be undertaken.

GRAPHS AND TABLES

Graph -1: The increase in the net amount of India's foreign debt

Graph-2: Merchandise Trade

Graph -3 Movements in foreign exchange reserves. Source — RBI Bulletin,2010

Table-1 (Unit: $ Billions)

Year (April-March) | Total External Debt | External Commercial Borrowings | NRI Savings | Short Term Debt |

2002 | 98.90 | 23.30 | 17.10 | 2.7 |

2003 | 104.90 | 22.50 | 23.10 | 4.7 |

2004 | 111.60 | 22.00 | 31.20 | 4.4 |

2005 | 132.90 | 26.40 | 32.70 | 17.7 |

2006 | 138.10 | 36.40 | 36.30 | 19.6 |

2007 | 171.33 | 41.44 | 41.24 | 28.13 |

2008 | 224.57 | 62.33 | 43.36 | 46.99 |

2009 | 229.88 | 62.67 | 41.55 | 49.37 |

Source: Reserve Bank Bulletin, 30 th June, 2009.

Table-2 (As % of total debt)

Year | 1991 | 1992 | 1995 | 2000 | 2002 | 2003 | 2007 | 2008 | 2009 |

Bilateral & Multilateral Debt | 41.6 | 45.8 | 49.3 | 50.5 | 47.8 | 39.5 | 30 | 29.4 | 26.2 |

External Commercial Borrowing | 12.1 | 14.1 | 13.1 | 20.3 | 23.6 | 22 | 24.2 | 27.8 | 27.3 |

Source: Calculated from Economic Survey, 2010

Table-3: Distribution of External Commercial Borrowings (Above $ 50 million)

Year | External Commercial Borrowings | As % of Total External Debt | As % of Total ECB | ||

Number of Borrowings | Amount of Borrowings | Public Companies | Private Companies | ||

2004 | 58 | 8,153 | 68 | 24 | 76 |

2005 | 75 | 8,536 | 72 | 22 | 78 |

2006 | 113 | 18,316 | 81 | 14 | 86 |

Source: Various

Table-4: The Main Consumers of External Commercial Borrowings

Year | The Consumers | Total Amount Taken ($ millions) | As % of Total ECB (above $ 50 million) |

2004 | Reliance + Tata + Mahindra + Bharati + Jindal | 3,184 | 39% |

2005 | Reliance + Tata + Bharati +Jindal | 3,030 | 35% |

2006 | Reliance + Tata +Bharati +Jindal + Essar | 6,955 | 38% |

2007 | Reliance+ADAG (Anil Dhirubhai Ambani Group) + Tata + Essar + Jindal | 14,670 | 31.22% |

2008 | Reliance+ADAG+Tata+Essar+Adani | 4540 | 26.76% |

Source: Mainly, Reserve Bank of India Bulletin, 2007.Assochem Report, 2009.

Additional Info: 1

Source: RBI (http://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=20940)

(It is like standing on a debt of 100 claiming 'Forex Reserve of 110-120!)

Additional Info: 2

Source:www.rbi.org.in/scripts/PublicationsView.aspx?id=12818

Additional Info: 3

RBI Press Release : 2010-2011/224 says: during April-May (2010-11), India's merchandise exports at US$ 33.0 billion posted a growth of 33.2 per cent over the corresponding period of previous year as against a decline of 33.3 per cent during April-May (2009-10). Merchandise imports at US$ 54.7 billion recorded a growth of 39.5 per cent as against a decline of 34.3 per cent during April-May (2009-10).

Additional Info: 4

Projected Debt Service Payments for ECBs and FCCBs | |||

(US $ million) | |||

Year | Principal | Interest | Total |

2009-10 | 8,633 | 2,057 | 10,690 |

2010-11 | 10,239 | 1,996 | 12,235 |

2011-12 | 13,877 | 2,367 | 16,244 |

2012-13 | 15,823 | 2,141 | 17,964 |

Source: same as that of additional info 1

Additional Info: 5

Position of Top Five Debtor Countries | ||||

External debt stocks, total (US $ billion) | Concessional debt/Total debt (EDT) (Percent) | External Debt to Gross National Income (Percent) | Forex Reserves to Total Debt (Percent) | |

China | 373.6 | 10.1 | 11.6 | 413.9 |

Russian Federation | 370.2 | 0.4 | 29.4 | 129.1 |

Turkey | 251.5 | 2.1 | 38.8 | 30.4 |

Brazil | 237.5 | 1 | 18.7 | 75.9 |

India | 224.6 | 19.7 | 19 | 137.9 |

Source: same as above

Comments:

No Comments for View